1, 2021 are eligible to utilize the gross receipts from the fourth quarter of 2020.Įligible entities include for-profit businesses, certain non-profit organizations, housing cooperatives, veterans’ organizations, tribal businesses, self-employed individuals, sole proprietors, independent contractors, and small agricultural co-operatives.

#Ppp2 gross receipts full#

Have used or will use the full amount of their first PPP loan and.Employ no more than 300 employees per physical location.( First-time PPP loans are once again available after December 27, 2020.) In addition, prior PPP borrowers must meet the following conditions to be eligible for the PPP2 Loans:

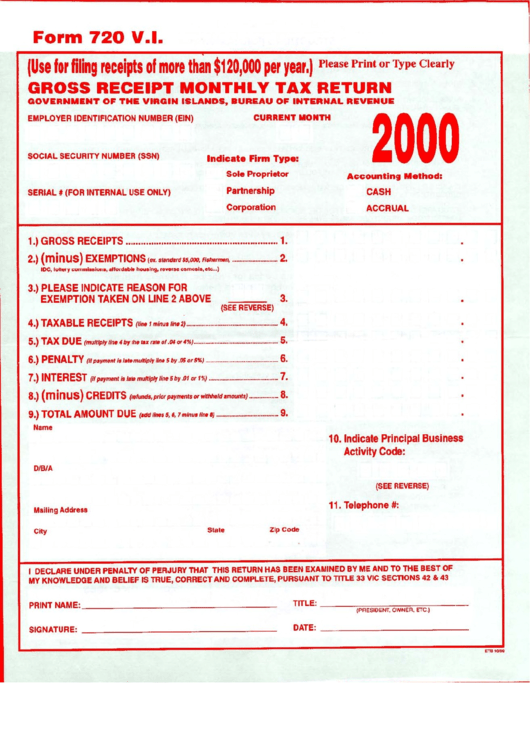

In order to qualify for a PPP2 Loan, a taxpayer must have taken out an Original PPP Loan. The CAA, 2021 permits certain smaller businesses who received a PPP loan and experienced a 25% reduction in gross receipts to take a PPP2 Loan of up to $2 million. Taxpayers could apply to have the loans forgiven to the extent their proceeds were used to maintain payroll during the COVID-19 pandemic and to cover certain other expenses. The provision established the PPP, which provided up to 24 weeks of cash-flow assistance through 100% federally guaranteed loans (Original PPP Loans) to eligible recipients. The CARES Act authorized the Small Business Administration (SBA) to make loans to qualified businesses under certain circumstances. In March 2020, the Coronavirus Aid Relief and Economic Security (CARES) Act was enacted. It also allows businesses to deduct ordinary and necessary expenses paid from the proceeds of PPP loans. Schreiber, J.D., ( ) is a JofA senior editor.The new law, the Consolidated Appropriations Act, 2021 (CAA, 2021), includes a second round of Paycheck Protection Program (PPP) loans. The notice explains (1) who are eligible employers (2) what constitutes full or partial suspension of trade or business operations (3) what is a significant decline in gross receipts (4) what is the maximum amount of an eligible employer’s employee retention credit (5) qualified wages (6) how an eligible employer claims the employee retention credit and (7) how an eligible employer substantiates the claim for the credit.Īlthough the Consolidated Appropriations Act, 2021, also extended and modified the credit for the first two calendar quarters in 2021, the IRS says this notice addresses only the 2020 rules and that it plans to release additional guidance soon, addressing the 2021 changes. In January, the AICPA requested clarification from the IRS on this topic and recommended that the filing of a PPP loan forgiveness application should not constitute an election to forgo the employee retention credit with respect to the amount of wages reported on the application exceeding the amount of wages necessary for loan forgiveness. The credit is equal to 50% of qualified wages paid, including qualified health plan expenses, up to $10,000 per employee in 2020, meaning the maximum credit available for each employee is $5,000.įor 2020, eligible employers that received a PPP loan are permitted to claim the employee retention credit, although the same wages cannot be counted for both. Notice 2021-20 explains in detail when and how employers that received a PPP loan can claim the employee retention credit for 2020. 1, 2021, and who experienced a full or partial suspension of their operations or a significant decline in gross receipts. 25.įor 2020, the employee retention credit can be claimed by employers who paid qualified wages after March 12, 2020, and before Jan. The IRS says the guidance in the notice is similar to the information it posted in FAQs last year, but the notice clarifies and describes retroactive changes under the new law that apply to 2020, primarily relating to expanded eligibility for the credit for taxpayers who took Paycheck Protection Program (PPP) loans. The AICPA requested authoritative guidance on the 20 employee retention credits from the IRS in a comment letter sent on Feb. The credit was created by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, P.L 116-136, and amended by the Consolidated Appropriations Act, 2021, P.L 116-260. In Notice 2021-20, the IRS issued detailed guidance for employers claiming the employee retention credit for calendar quarters in 2020.

0 kommentar(er)

0 kommentar(er)